Guatemala’s Alcohol Tax Helps Advance Reproductive and Maternal Health

Guatemala’s Alcohol Tax Helps Advance Reproductive and Maternal Health

In the past five years, Guatemala has made significant progress in reducing the maternal mortality ratio from 113 to 85 maternal deaths per 100,000 live births. However, inequalities within the country persist. Almost 20% of maternal deaths occur among women under 24 years old, and Indigenous women continue to face disproportionately high risks. Although Indigenous people represent 44% of Guatemala’s population, they account for nearly two-thirds of maternal deaths—most in the Western Highlands.

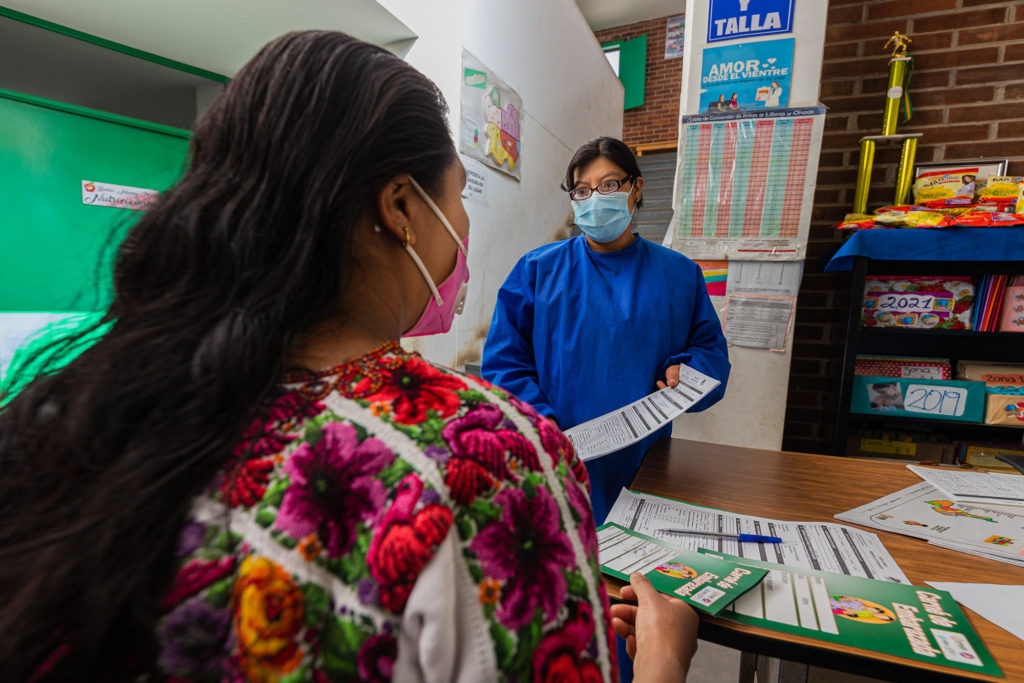

Since 2019, MSH, through the Healthy Mothers and Babies in Guatemala project, known locally as Utz’ Na’n, has partnered with local and national actors to improve the health of Indigenous pregnant women, mothers, and their newborns. The project focuses on expanding access to and use of high-quality, culturally respectful antenatal and postnatal care. Today the project operates in the departments of Quetzaltenango, San Marcos, Sololá, and Totonicapán.

Utz’ Na’n’s group antenatal care (ANC) model—adapted to local contexts—has contributed to earlier and more consistent ANC attendance among Indigenous women. Its success helped inform national guidelines, and the model has now been formally incorporated into the Guatemalan national norms on integrated health care. Utz’ Na’n’s approach also integrates maternal and child nutrition, focusing on the critical first 1,000 days (from conception to age two) to ensure Indigenous mothers and babies receive the nourishment and care they need.

Turning Alcohol Taxes into Maternal and Reproductive Health Gains

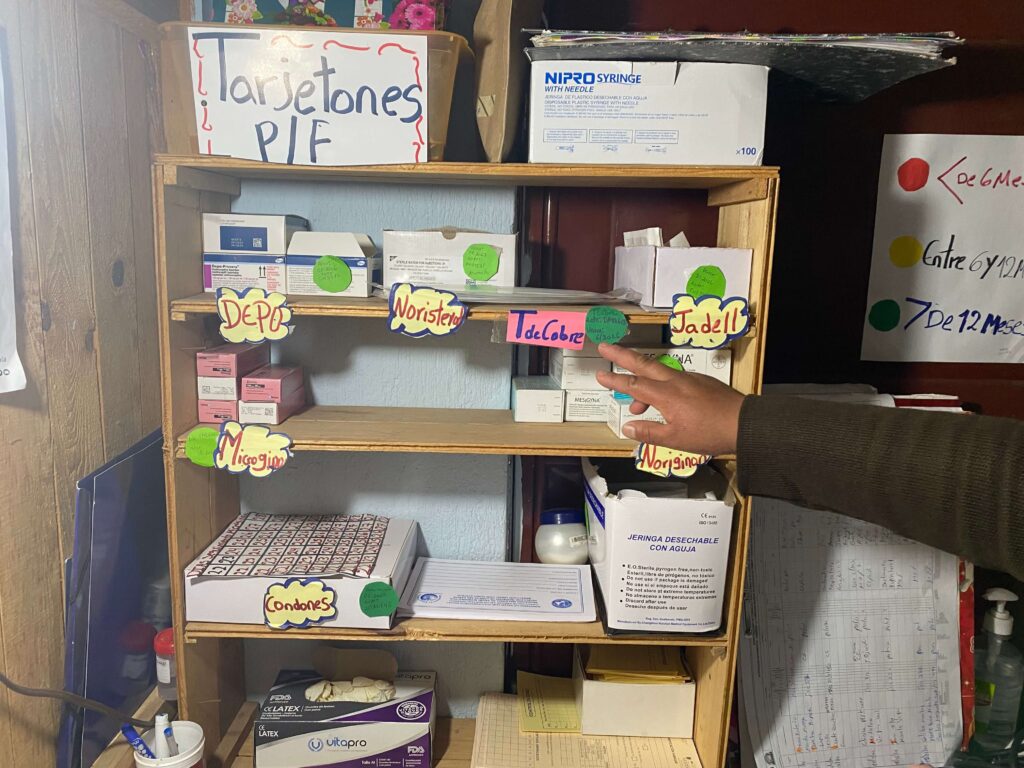

A persistent barrier to advancing the quality of reproductive and maternal health and preventing adolescent pregnancy is consistent access to maternal and newborn health supplies and contraceptives. Stockouts are common, particularly in rural areas and for lifesaving commodities such as anti-shock garments to assist with obstetric emergencies. The strategy for postpartum home use of misoprostol by traditional birth attendants also lacks guaranteed supply. There is also a shortage of OB/GYNs in rural areas and a need for more effective procurement systems to supply the full range of contraceptive options.

To help address these gaps, Guatemala enacted legislation in 2004 mandating that 15% of the revenue from taxes on alcoholic beverages be allocated to the Ministry of Public Health and Social Assistance (MSPAS) for reproductive health programs. This funding aims to reduce maternal and newborn deaths and expand access to reproductive health services, including through the procurement of contraceptive supplies. In 2010, the Law for Healthy Motherhood strengthened this policy by requiring that 30% of the earmarked funds be used specifically for the purchase of contraceptive supplies—and that none of the funds be diverted for unrelated purposes.

The alcohol tax revenue is distributed to departments and to hospitals based on national and departmental priorities, past implementation performance, and identified needs. The law also improved budget transparency by requiring MSPAS to include a dedicated reproductive health line item in the national budget and track how funds are spent. For 2025, the 15% share of the alcohol tax totals over Q125 million (approximately USD $16.3 million).

Utz’ Na’n Budget Monitoring and Social Accountability

Through Utz’ Na’n, MSH partners with the National Observatory for Sexual and Reproductive Health (OSAR), a multi-stakeholder network with observatories in 21 departments established by the Guatemalan Congress to uphold the right to health. OSAR plays a key role in monitoring legislation and policies related to reproductive, maternal, newborn, child, and adolescent health (RMNCAH), including how the 15% alcohol tax funds are allocated and used.

Ensuring that women—especially Indigenous women—can participate in the tracking and oversight of public resources allocated for their health and that of their families is critical to strengthening social accountability. To support this, OSAR makes detailed, searchable data on the 15% tax funds publicly available on its website.

OSAR has made several recommendations to improve planning, monitoring, and impact measurement at the departmental level, including:

- Better aligning departmental and hospital-level allocations with the National Reproductive Health Program’s strategic plan, aiming to reduce maternal and neonatal mortality and improve reproductive health, with measurable indicators tied to budgetary investment.

- Basing allocations on locally identified needs and diagnostics, as reflected in each department’s annual operational, procurement, and contracting plans.

- Exploring centralized purchases or alternative mechanisms to make better use of available resources for procuring the full range of contraceptive methods.

Utz’ Na’n also works with OSAR to strengthen the capacity of civil society partners and networks, including Indigenous women’s organizations, to track policy and financial commitments. In parallel, the project supports departmental health teams to prevent stockouts of essential RMNCAH commodities by training them in budget tracking and financial oversight. Leveraging the alcohol tax to increase access to lifesaving, high-quality reproductive health commodities, including contraceptives, is one of several strategies the Utz’ Na’n supports in partnership with the MSPAS to improve the health of Indigenous pregnant women, mothers, and their newborns.